Originally posted on April 6, 2021 on the Association of Strategic Alliance Professionals (ASAP) blog.

The 2021 ASAP Global Alliance Summit was a time for networking with peers in virtual mixers and learning from a variety of expert speakers. However, it was also a forum for combining the two activities. This year’s Summit program featured a new twist: a set of master classes, in which veteran alliance management consultants facilitated discussions with attendees from multiple industries about the profession’s most pressing challenges.

Jessica Wadd and Jonathan Hughes, partners at management consultancy and longtime ASAP sponsor Vantage Partners, facilitated a session titled “Understanding and Aligning Partner Business Plans,” during which participants began by discussing why one-quarter of alliance underperformance stems from gaps in the joint alliance planning process, a figure that came from Vantage Partners’ 2019 Strategy and Execution Study, which included 316 responses from more than 200 companies.

What We Have Here Is a Failure to Communicate

Attendees uncovered five common gaps in joint business planning that reduce or delay value realization in partnerships:- Failure to engage the right stakeholders at the right time

- Failure to work backward from the core customer need

- Failure to translate concepts into concrete opportunities

- Failure to have hard conversations about differences in partner organizations—where each is willing to be transparent and where they can’t

- Failure to implement processes for responding to changes in the market, partner organization dynamics, and coopetition

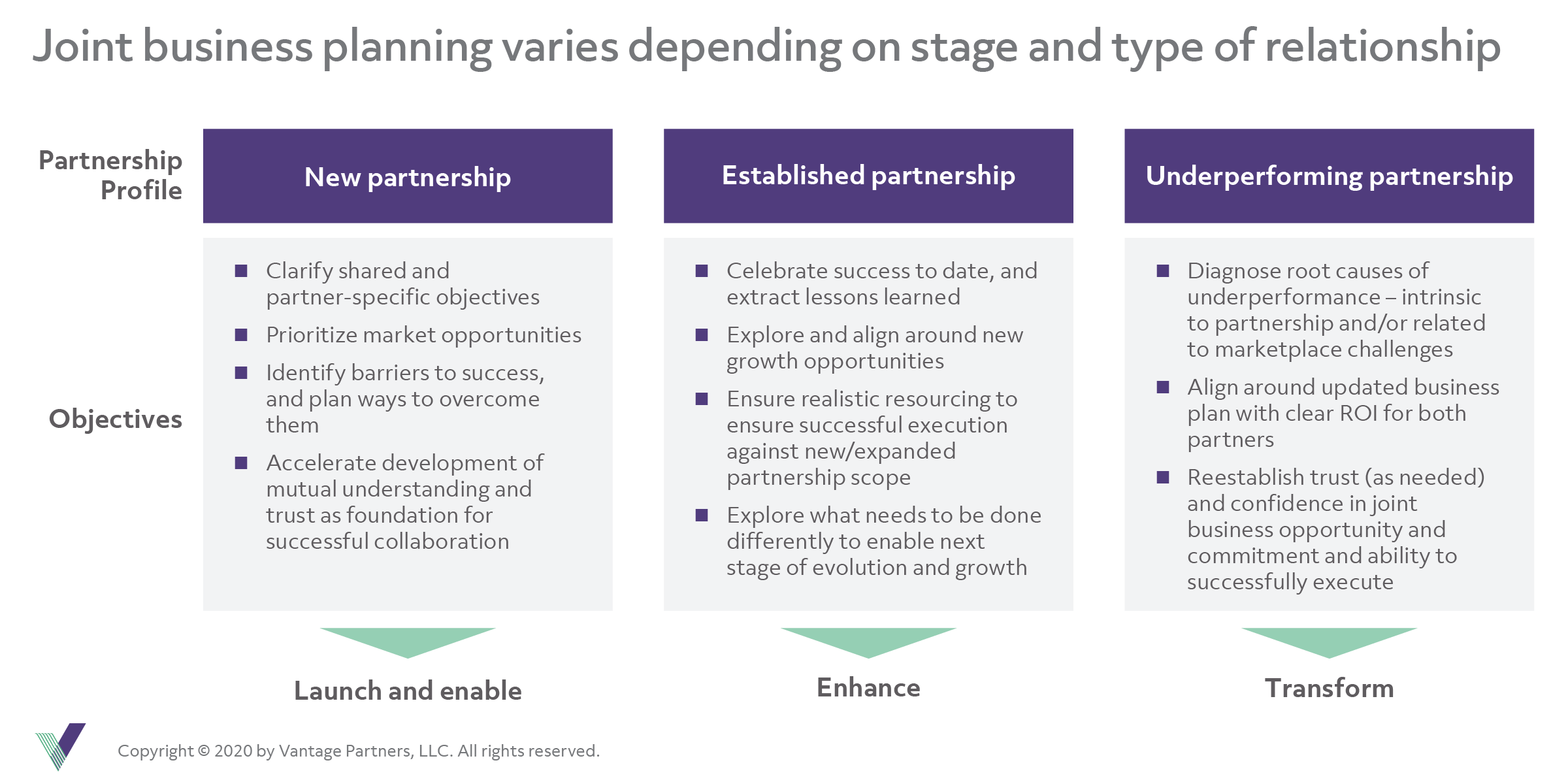

While these mistakes are common, Wadd and Hughes offered that companies can increase partnership ROI through systematic and agile joint business planning processes for new, established partnerships with potential, as well as underperforming alliances (see chart "Joint Business Planning Varies Depending on Stage and Type of Relationship" below).

Value Discovery Process Not Always Kumbaya

Before companies can realize returns from their partnerships, they need to identify and prioritize opportunities to create value for themselves and their shared customers. Hughes guided attendees through a process of value discovery based on an analysis of the alignment between each company’s strategy and the larger market context.

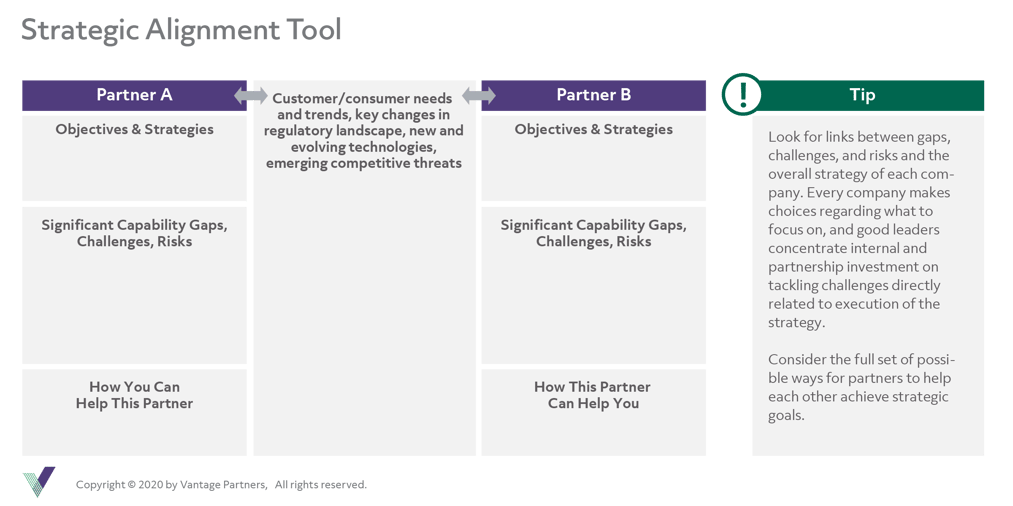

The "Strategic Alignment Tool" below is deceptively simple. “It’s a key part of [an alliance manager’s] job to not just fill it out, but lead or facilitate the process of filling it out,” according to Hughes.

Alliance managers must collect perspectives from stakeholders across their business (e.g., sales, project management, R&D, engineering, and marketing) and use this information to help a steering committee select the best projects to pursue. As Hughes explained, “You’ve got to come together with the partner and share each side’s view and see what the degree of alignment and intersection with those partners [is]. More often than not, there is one or more goals that the partner has that the other says, ‘Not a priority for us.’”

As one attendee noted, this process forces executives to discuss not just the places where their goals and priorities align, but also where conflicts might lie. While leaders often “want it to be kumbaya,” he said, it is usually better to engage in difficult conversations at kickoff so that teams are more equipped to deal with differences when they arise in execution.

Three Elements of Value Delivery a “Big Part” of Avoiding Underperformance

While Hughes focused on helping companies identify the projects that are worthy of investment, Wadd led a discussion about how to leverage joint business planning processes to enable delivery against selected projects. Conversation centered around three key areas:

- Clarifying targets

- Establishing metrics

- Using an agile execution planning process

Wadd provided several templates for each stage of the process, and the ensuing discussion centered around a few practices that differentiate exceptional joint business plans, such as:

- Identifying concrete targets for each priority project that reflect the critical measures of success within each company—whether that is sales (and associated pipeline progression), scientific progress, or operational effectiveness. Many attendees shared stories of alliances with shadow internal scorecards on each side that did not fully align to the shared scorecard, and the resulting drag on alliance performance.

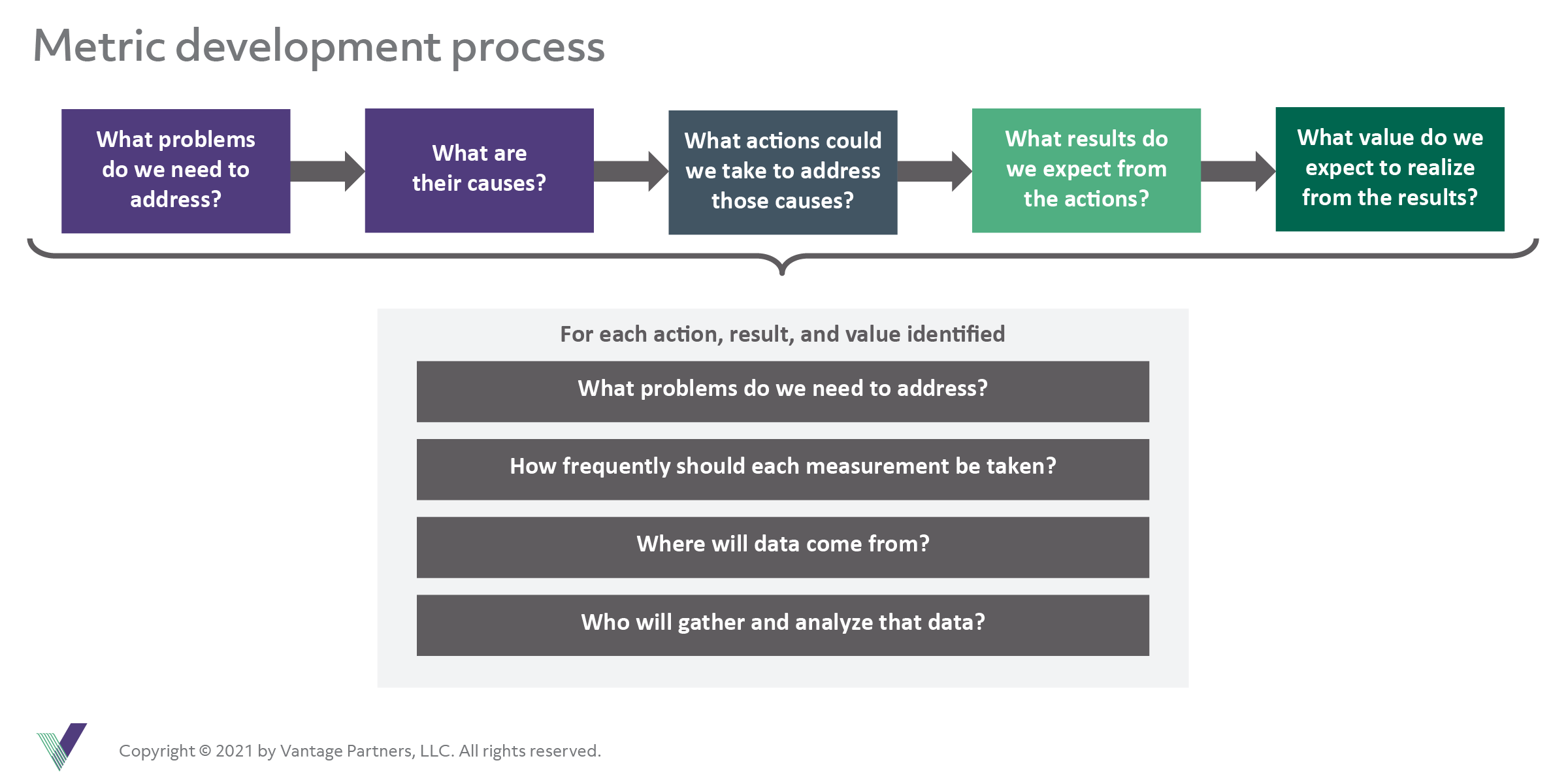

- Creating metrics that surface problems and enable partners to address them before they get out of hand using the following framework (see chart "Metric Development Process" below):

- Defining short sprints for execution where the business plan includes not just the actions partners will take, but also their strategy or approach for each workstream and the major challenges they expect to encounter during execution.

When asked by a member of the breakout group if this is the answer to the original question of why 25 percent of alliance underperformance can be traced back to incomplete planning, Wadd replied, “It’s a big part.”

The full presentation is available for download by visiting Vantage's 'virtual booth' from the ASAP Summit.

.png?width=512&height=130&name=vantage-logo(2).png)