by Michael Kalikow

In recent years, the phrase “trusted advisor” has become somewhat of a buzzword, and in many situations is used synonymously with having a good relationship with clients. After all, regardless of whether we are selling goods, services, or integrated solutions, in any industry where we have clients or customers, who wouldn’t want to have good relationship with those we serve in the marketplace. But, from our vantage point, being a trusted advisor is much more than having a good relationship. In this article, we explore what it takes for a sales professional to become a trusted advisor, and how establishing this kind of business relationship can be instrumental to long-term competitive advantage.

The salesperson as "advisor"

An advisor is someone whose advice, counsel and perspective we take into account in order to inform our decision making, and help us address business critical challenges. In the sales context, we’re drawing a distinction between the quality of the products and solutions we offer, and our ability to essentially step into a consultant role and help our customers and counterparts make business decisions. This is often referred to as solution selling or consultative selling, and is critical to being a trusted advisor. But it’s not enough. We see being a trusted advisor as a step beyond solution selling because it’s also about the kind of relationship we’re establishing. When we’ve become a trusted advisor, our customers listen seriously to our recommendations and value our perspective as they make choices for how to solve the underlying business challenges that our products or services address. Getting to this point where our clients regard us as an advisor is all about trust.

Thinking critically about trust

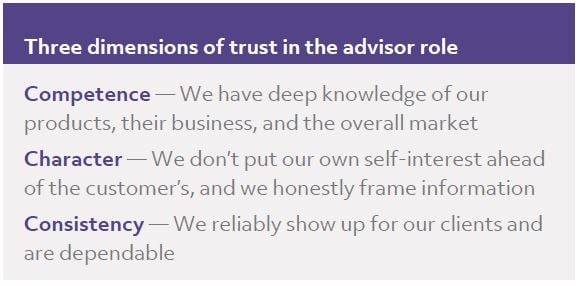

Trust is one of those that things that most of us base on a gut feeling. We know it when we see it. But, we often find there’s a gap between our ability to recognize trust in others, and being able to break down the different qualities that constitute trust so that we can use this as a guide to creating better relationships with customers. We define trust as having three core dimensions: competence, character, and consistency.

Competence

As a starting point, if we are to be deemed a trustworthy resource in our customer’s decision making, we need to be viewed as “competent,” which means we’re good at what we do and we know what we’re talking about. In the sales context, this typically involves understanding the industry (both our own and our customer’s), the customer’s business, and the ins and outs of the particular business challenge they are facing.

For example, if we are selling medical devices, competence in the trusted advisor role is more than just understanding our own products and services impeccably. In addition to knowing what our competitors are doing, and the larger trends in the medical device space, being a true trusted advisor means fluency with the broader healthcare industry overall, and the ability to help our customer address the unique challenges they face — such as how a hospital should structure their joint reconstruction spend in the changing reimbursement environment brought about by the Affordable Care Act. The medical device sales rep isn’t being asked to become a hospital consultant. But, they are being asked to think beyond the performance of their products in the operating room, and look at how the things they sell can help address a larger set of business concerns.

As you can see from this example, competence in this context is broadly defined. Sales professionals who want to become trusted advisors need to push their thinking beyond their own products or services to see the bigger picture that their customers operate within. Additionally, competence is domain specific. In other words, we can be deemed competent around certain subject matters (such as our own products) but incompetent about others (such as what’s happening in our overall industry). The broader our competence, the more credibility we will have with our customers, and therefore the more likely we are to be regarded as a trusted advisor.

Character

The next attribute of trust is “character.” In this context, by “character” we are referring to two specific and interconnected traits. The first is honesty. Do we tell the truth, and when we communicate with clients, do we provide a complete picture of the situation, or do we leave out critical information? The second is about whose interests we put first. Customers will trust those they feel have their best interest at heart. Of course, our customers recognize that we’re compensated by making sales, but to be regarded as a trusted advisor our customers need to experience us not putting that self-interest ahead of their interests. Otherwise, they will view all of the advice we share as ultimately self-serving.

To be clear, we’re not saying you have to abandon self-interest altogether. Rather, when we help a client think through a particular decision, we impartially talk through the pros and cons of their various choices as objectively as possible, taking into account their full range of interests (e.g., price, quality, speed, convenience, satisfying internal stakeholders, the quality of their relationship with the provider).

For example, a rep who sells equipment to corporate and academic research labs might say something like, “If budget is your primary concern and you only need to conduct a limited number of procedures, we’d recommend looking at our low end model here, which would meet your basic requirements. If you’re more concerned about avoiding downtime due to maintenance, and you’d also like to run an expanded range of tests, we’d recommend this particular model.” Obviously, the rep benefits more by selling the higher end product, but if the buyer views them as pushing the high priced model, they will be seen as a vendor putting themselves first, instead of a trusted advisor who is helping them make the best decision for their lab. If the rep is in the vendor role, they are more likely to lose the sale for the higher end model even in those circumstances when it would actually meet the customer’s needs better.

Consistency

The final dimension of trust is “consistency.” This boils down to showing up for our clients and being reliable. It’s about following through on commitments, and making the extra effort to be available and responsive on the customer’s schedule. It also means that we consistently embody the other characteristics of a trusted advisor (competence and character) and demonstrate them to our clients and customers on an ongoing basis.

Making the shift from "vendor" to "trusted advisor"

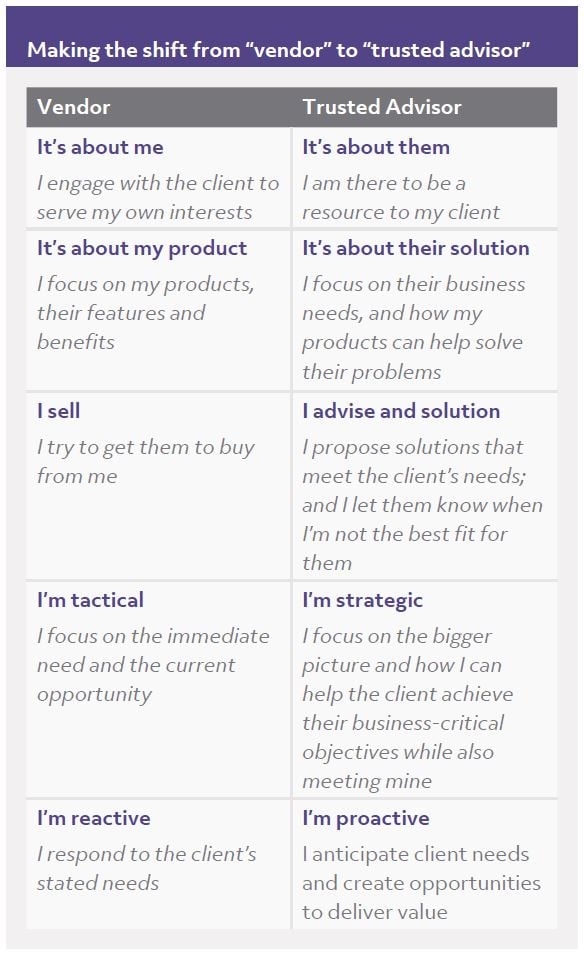

Ultimately, moving from being seen as just a supplier or vendor by our customers to being seen as a trusted advisor is a paradigm shift that requires us to evolve how we think about our role with customers, and how we engage with them throughout the sales and account management process.

There are many implications to the trusted advisor relationship. The following are three illustrative ways that engaging with customers and clients as a trusted advisor differs significantly from being seen just as a vendor by our customers.

Product versus solution

The vendor’s primary focus is on their products or services, and conversations with customers center around these offerings and their features and benefits. By contrast, a trusted advisor is more concerned with understanding the customer’s business challenges and helping them best meet those needs. The trusted advisor spends time asking the customer questions so that they can both better understand the challenges that the customer is trying to address. Discussions about products and services are connected to addressing these underlying business problems. As a result, the customer takes their input and perspective into account as they make purchasing decisions.

Selling versus advising

Similarly, a vendor’s goal is to make the sale whereas the trusted advisor seeks to help the client make the right decision. This has many implications. For example, the vendor will respond to the client’s stated need and essentially take orders, while the trusted advisor will take a step back and look at the bigger picture. Is now the right time to buy? Do we focus on the small order here, or do we explore how we might add more value by offering a more comprehensive solution? At times, do we even let the client know when working with us might not be the best choice for a given opportunity?

At first glance, telling someone not to work with us sounds like a recipe for disaster. But it’s sometimes the right move, and can end up winning us more business in the long term. Take for example a rep who sells custom software solutions to financial traders at banks and hedge funds. As they speak with potential users in an account, do they try to sell everyone regardless of fit, or do they analyze each trader’s unique work flow, and help each one make the best choice for themselves? In the face of increasingly demanding sales quotas, it may seem counterintuitive to advise a potential client not to buy from us. But, it actually makes a great deal of sense when we think about managing critical commercial relationships over the long-term. After all, in this example if 85% of the traders at the account are a good fit for our product, we would certainly be better off ferreting out the 15% who aren’t, so their likely negative experience with our product wouldn’t turn off other potential buyers who would benefit from our products and become loyal customers.

This deal versus the overall relationship

It can be difficult for sales professionals to focus on longer term relationships with customers when there’s so much pressure from management to hit quarterly sales numbers. Indeed, it’s very hard not to push hard for a deal that’s going to impact your overall compensation for the year. At the same time, taking the longer-term view with customers is a central part of what it means to be a trusted advisor, and sometimes this can mean playing the longer-term game.

The trusted advisor genuinely cares about their client and seeks to provide as much value as they can while being fairly compensated in return. This isn’t about giving discounts or doing work out scope (and we would argue that making unwarranted concessions such as these actually erodes the relationship with customers). Rather, it’s about structuring relationships that work for both parties, sustainably over time. Accordingly, the trusted advisor assesses each potential deal up against its potential impact on the long-term value stream. People can generally tell whether our regard for them is genuine or not. By genuinely caring about the relationship, the trusted advisor positions themselves to attain more business over time.

A customer-centric approach to sales

Selling in the trusted advisor role, basically comes down to engaging with the customer in ways that put the customer first, and create value for both parties over the long term. This plays out in many ways and is a fundamental contrast to selling in the vendor relationship. In today’s increasingly competitive marketplace, the way we do business and the relationships we establish can materially impact buying decisions. Establishing a trusted advisor relationship with customers and clients is a powerful way to achieve competitive advantage and to decrease the risk of losing accounts to competitors.

Authors:

.png?width=512&height=130&name=vantage-logo(2).png)