No account leader in a professional services firm ever relished the prospect of talking to a client about a scope overrun. There is often a temptation to avoid the conversation and simply suck it up, rationalizing it’s better for the relationship and for future business.

Some firms try to rectify the situation by creating fairly strong disincentives for write-offs, which only serves to put partners, MDs, and others responsible for account growth and health firmly between a rock and a hard place.

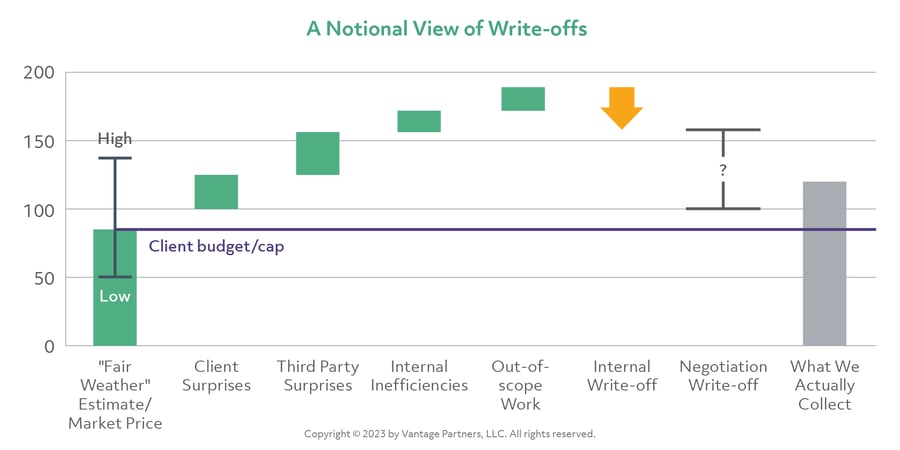

There’s a better way to reduce write-offs, and it doesn’t have to come at the expense of the client relationship and future opportunities. It starts by understanding the myriad contributors to write-offs in a typical project. Take a look at Figure 1. How many of those contributors to write-offs feel familiar? Are there any that you’ve been able to eradicate entirely?

If you’ve worked diligently at some of these causes, your firm may have significantly reduced your write-offs, or at least appeared to have done so. But have you considered the impact of your hidden write offs?

Hidden write-offs go like this: Managers tell their team members that a set of tasks was budgeted to take a certain amount of time. Faced with the prospect of seeming “not quite good enough,” junior staff tend to write down their own time, rather than account for any hours in excess of those numbers. The problem is that they are actually working those longer hours, are unavailable for other work, and will suffer from the early burnout, whether they report those hours or not. The firm is still not getting paid for the effort they put in. And to compound the problem, now they won’t have the data about what it really takes to perform those activities.

Whatever the realities of your write-offs, it’s important to recognize that even small write-offs can have a significant impact on your bottom line. Write-offs represent lost income up against costs already incurred. Overhead and cost of sales have been covered, as has the time of the team performing the work. But out of scope work that is written off represents pure margin loss. One way to think about the value of reducing write-offs is in comparison to new sales: If you operate at a 25% margin, for example, each dollar “earned” by avoiding a write-off represents the bottom-line equivalent of $4 in new sales.

The key to reducing write-offs? Avoid putting senior leaders in the position of going to the client to say, “You crossed a line by asking for too much or failing to hold up your end, and to prove that you are in the wrong, you have to pay us some money you hadn’t budgeted.” (And a big part of the reason why they hate having to say those things is that they set the client up for the perfect response: ”Why are you telling me about this now, when I can’t do anything about it?”)

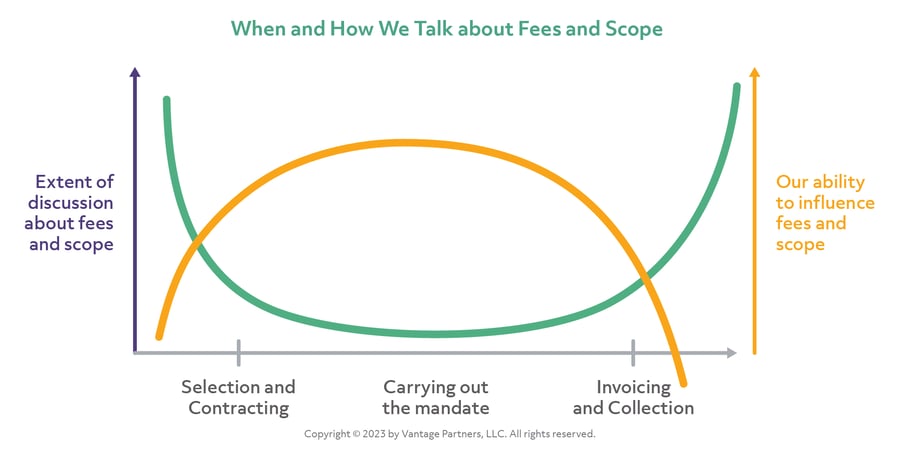

It's all about timing. The sad reality is that most professional services firms are not very good about talking about changes in scope until it’s far too late. Take a look at Figure 2. Does that pattern feel familiar?

So, whatever else you are doing about standardization and automation, optimizing your staffing mix and leverage models, or even improving your estimation and pricing, there is likely additional room to add meaningfully to your margins. Ensuring that delivery and account teams are well-aligned around certain scope management principles will enable leaders to engage clients earlier about changes in scope.

In my experience, these are the three that have the greatest impact.

- Make it easier to discuss internally — Effective communication about scope expectations, creep, and changes starts within the delivery and account teams. Make it a part of your delivery culture that it is OK for a junior staff member to raise their hand and ask whether something seems out of scope. They don’t need to make the decision to raise it with the client, but they should be encouraged to bring it to the attention of team leaders.

- Maintain a scope creep ledger — There will always be some level of scope creep, and certain things a professional services firm will prefer to simply take care of without raising it or charging for it. That’s OK, so long as it is a decision and not happenstance, and that you get the data about where the time went. Then you have an opportunity to share with your client a collection of such actions you have taken for their benefit, at no additional charge. If you are going to incur write-offs, at least get a bit of credit for it!

- Give clients choices — This is the most important thing you can do. Going to a client after the fact with a complaint and an invoice feels terrible and puts the relationship at risk. But going to them in advance, with some options about how to proceed, does the opposite. You just have to make sure that those options always include at least one that does not require them to write you a check (e.g., descope something else, shift some tasks to the client team, act on some offsetting savings in another part of the project). By doing so, you’re showing the client you care about the project and their needs, and that you are sensitive to their budget constraints. You are not surprising them with a problem; you are giving them more agency over scope and budget management and making them a part of the solution. Which is great for the relationship … and the bottom line.

Landing new logos is always exciting, but not always within your control. Rolling out a new offering you can pitch to your clients is a great way to expand your relationships, but requires significant investments. Reducing write-offs is something that you can control, and if done well, pays dividends both in terms of profitability and client relationships.

Click here to read more on our experience with professional services clients.

.png?width=512&height=130&name=vantage-logo(2).png)