Life Sciences Market Access

We Help Enhance Product Launch Strategy and Local Execution.

Amidst intensifying cost pressures, competition, and increasing scrutiny from payers, pharmaceutical and device makers must actively monitor and improve their product launch capabilities to defend (and when possible, create) value.

Vantage Partners works with leading pharmaceutical and device companies to navigate the complexities of global product launches and subsequent negotiations to maximize the value realized by their products in the marketplace.

We typically engage 12 months before launch, through the launch period, and also support ongoing reimbursement negotiations.

Vantage empowers your global and local market access teams to defend and even create value as they execute the “last mile” of the access journey.

We do this by enhancing individual skills, combined with a structured approach that builds on existing value dossiers, objection handlers, and evidence to identify a discrete set of negotiation scenarios for each product. We use these scenarios to inform market engagement, identify practical deal design structures, and shape negotiation strategies and tactics that address both biopharma and payer needs.

Map

- Landscape and stakeholder mapping

- Market shaping strategy and support

- Definition of commercial and negotiation scenarios

Align

-

War Gaming and competitive strategy simulations

-

Cross-functional launch communication plans

-

Value communication tools

-

Building (and testing with stakeholders) innovative contracting strategies

Design

- Crafting and refining product-specific negotiation narratives

- Building (and pressure-testing) product and market-level negotiation strategies

- Creating deal-design and negotiation playbooks

Execute

- Creating practical negotiation decision trees

- Facilitating mock negotiations

- Providing expert advice and coaching to local account/affiliate negotiation

Vantage also enables global and emerging life sciences leaders to drive successful collaborations. Our strategic counsel and operational enablement supports research, development, and commercial alliances at every stage of the partnership lifecycle. Learn more.

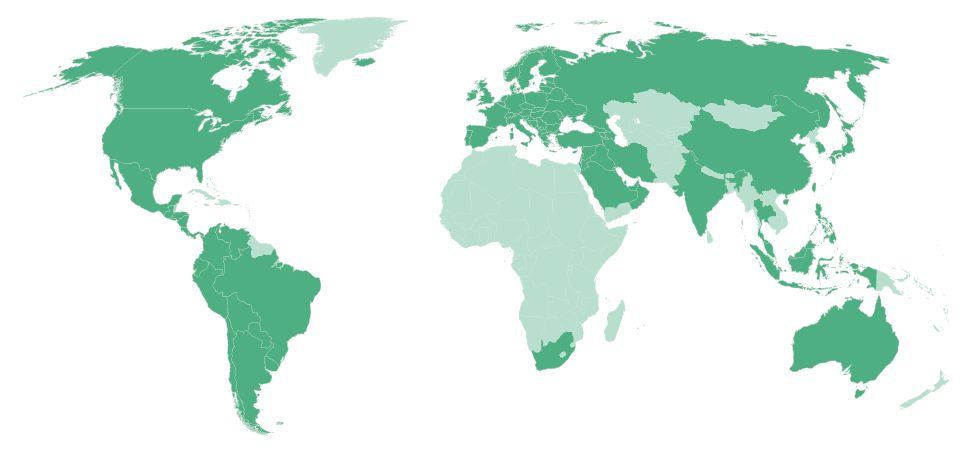

Supporting Market Access Teams Worldwide

Our team operates globally, with deep expertise across the US, Europe, Latin America, Asia and developing markets. We work across therapy areas with particular expertise in oncology, infectious disease, diabetes, inflammation, and vaccines.

Put Your Market Access Negotiation Instincts to the Test

Put Your Market Access Negotiation Instincts to the Test

Imagine you’re launching a high-value therapy in a competitive category and you’re expecting strong pushback. What is your approach? How can you carefully respond to objections strategically and pivot back to value? This brief three-question activity will test your negotiation instincts, and offer a sample of the guidance and advice Vantage Partners has to offer.

Our Market Access Impact

For more than 25 years, Vantage has worked with global and emerging life sciences leaders to prepare for launch of new therapies, to jumpstart stalled negotiations, and to solve a broad array of commercial challenges.

A global biopharma faced a major challenge: Its high-efficacy, high-cost oncology therapy was stalled in access negotiations in more than half of its top-ten markets. The therapy had a new mechanism of action and a complex value story. Payers balked at the price, with a number of key markets indicating they did not expect any agreement to be reached.

The global access team brought in Vantage to engage multiple affiliates, diagnose how to break the reimbursement negotiation deadlock, and equip later-launching markets to succeed. Our engagement with these markets uncovered three specific challenges:

- Payers were not recognizing all of the ways the new therapy impacted payer costs

- The value story needed to be reframed such that payers could appreciate the unique mechanism of action

- Some markets were best accessed through an outcomes-based agreement

Vantage worked in parallel with each of the stalled markets and the global access team. Together, we:

- Rapidly enhanced negotiation tactics

- Injected refreshed messaging into the process

- Crafted targeted outcomes-based agreements to respond to payer uncertainty about the value of the therapy.

Our client, a leading global biopharma, faced a unique challenge: With multiple assets launching in a new therapy area, the company needed to rapidly equip market access and cross-functional teams to engage effectively with new stakeholders in a new and highly competitive environment.

Vantage partnered with the therapy area leadership to deliver a focused set of negotiation and influence trainings to build skills. To pressure-test strategies and further enhance negotiation skills, we integrated these negotiation and influence trainings with product-specific trainings and supported a set of practical negotiation simulations for each launching product.

More than 100 people were trained in a three-month period, creating a shared picture of negotiation success while building and enhancing relationships across the new therapy area. Each of the first three assets launched in the new therapy area exceeded revenue projections.

A large US-based biotech faced new biosimilar competition for its highest revenue product. US payers were eager to use this entry to rapidly reduce prices, frustrated by the perceived “high cost” of the biotech’s therapy. National account teams feared a no-win situation and pleaded for higher discounts.

Working with the US national accounts leadership, Vantage conducted competitive planning workshops with multiple national account teams. This surfaced an opportunity to:

- Proactively engage payers

- Highlight the benefits of the existing therapy

- Underscore the potential challenges and delays of the not-yet-launched biosimilars.

Team-level negotiation planning followed these sessions, resulting in the creation of “negotiation decision trees” for each national account team to manage discount requests. The result of this disciplined negotiation planning and execution: margin and share impacts from the biosimilar launch were 50% less than projections in year one and 30% less than projections in year two.

A US-based medical device company faced shrinking sales and a perception of reduced field team enthusiasm. Mid-level sales leaders struggled to drive their teams to maximize impact, and increasingly felt their focus pulled away from supporting account teams.

Working with the sales leadership team, Vantage helped shift the mindset of the mid-level leaders with a customized two-day sales leadership workshop, which enabled leaders to systematically assess their district and team performance and create action plans to best meet the needs of both their teams and of the business. Vantage supported these sessions with custom tools, implemented within Salesforce, that now are used by sales management across the organization.

Company sales rebounded. The two-day sales leadership workshop received a 100% overall effectiveness rating from participants and is now the capstone experience within the company’s leadership development program.

During the early stages of the COVID pandemic, Vantage supported a global biopharma in navigating the unprecedented pandemic access negotiation environment in 2020. The biopharma’s COVID therapy was launching with urgency, and also with limited data, little competitive pricing information, and no way to create a traditional cost-effectiveness or budget-impact model. Unmet need was exceptionally high, and traditional access and reimbursement processes were too slow to respond.

To succeed, the client needed new approaches to navigate payer negotiations and a way to rapidly make commercial choices and align with payers on reimbursement. Working closely with the leadership team, Vantage designed virtual multi-party competitive simulations to help this biopharma better understand the reimbursement environment, pressure-test its pricing and contracting assumptions, and anticipate how payers might operate in this uncertain context.

The simulations yielded strategic insights about positioning the COVID therapy for maximum patient impact; enhanced velocity of commercial contracting; and suggested an “indicated price” which was proven to be within 5% of actual negotiated prices months later.

A global vaccine manufacturer faced a new challenge: to achieve maximum public welfare benefit from a new asset, it needed not only to achieve funding at the national level but also to “partner” locally with various distribution and administration partners in each market. The discussions with national payers and local distribution and administration “partners” needed to proceed in parallel, as decisions of each impacted the economics for the other. Early market engagement suggested that local teams were uncomfortable with the strategy, fearing the complexity of parallel negotiations.

Vantage worked with the global launch team to define a negotiation guide for individual markets, simplifying the process and creating a set of practical questions to pose to key government and private-sector stakeholders to frame the opportunity at the local level. Then, Vantage supported local workshops to create a bespoke strategy for each pilot market, creating three early “wins” with defined pathways to market.

These “wins” empowered affiliates in more than a dozen additional markets to successfully engage their payers and private ecosystems.

Our client, a Europe-focused biopharma, was launching a second-to-market therapy with a complicated value story and limited trial data. The clinical value proposition resonated with some payers and not with others, and the launch schedule suggested that several early-launching markets might set unfavorable reference-pricing agreements.

Vantage worked with the access team to set up a “negotiation launch office” to engage key European markets early in the launch cycle (up to 12 months before launch), engage payers and other stakeholders in each market, and use these insights to build alignment around launch positioning.

This approach continued through launch, with Vantage coordinating tactical negotiation support for each market, and ensured best practices and learnings were leveraged and shared with subsequent launching markets, optimizing results for each.

Our client was launching a third-to-market therapy in a highly competitive chronic care therapy area. Clinical differentiation was limited, and the Global Market Access team feared steep discounts were the only path to market.

To respond to this challenge, Vantage worked with global access team to define a small set of value-added services that would benefit different profiles of health system stakeholders. We developed a “playbook” to support affiliates in mapping, engaging, and shaping proposals to maximize the benefit of the integrated value proposition. Then, Vantage provided coaching and support for implementing these services at the market level.

More than 50 affiliates across the globe evaluated value-added services, with multiple top-10 markets achieving access based on the inclusion of targeted value-added services.

In an important European market, a global pharmaceutical company faced significant challenges in negotiating the price of an innovative but very high-priced oncology treatment.

In this situation, the company was second to market, with first mover advantage taken by a competitor who had entered with a lower price. And while our client had a better product, stronger data and proven efficacy, the government payer – under significant budget pressure – balked at the higher price our client needed to achieve. Their going-in request for a discount would not have made this treatment financially sustainable.

We worked with the client to determine the key interests of the payer (beyond price) – interests that at first were not revealed or fully understood. In the interests discovery process, we dug deeper to learn that the payer was concerned about whether our client had the infrastructure to support the treatment if the demand was what both parties expected. (The treatment required a network of physical treatment centers that would have to be available immediately upon launch.)

So in addition to addressing the payer’s concerns about price and efficacy, our client was able to present a detailed infrastructure plan and assume the expense risk should demand fall short of projections. By providing tangible options to meet the payer’s true interests, our client positioned themselves as a partner rather than an adversary in the negotiation process.

Discovering “what else matters?” resulted in a successful launch at a price the payer found reasonable and our client embraced as financially viable.

Groundbreaking Research. Renowned Negotiation Expertise. Decades of Sales and Pharma Commercial Practice.

Articles by Vantage executives regularly appear in Harvard Business Review, SAMA Velocity, MIT Sloan Management Review, and California Management Review, among other leading journals. Groundbreaking Vantage research includes our Cross-Selling, Value of Pricing Discipline, and Customer-Supplier Negotiation studies.